Bitcoin miners and renewable energy

Bitcoin miners can accelerate the shift to renewable energy but they won't help reduce emissions.

Welcome to the second edition of the Climate Chain newsletter from All for Climate DAO! We are a community of crypto enthusiasts interested in using crypto to accelerate the transition to a new sustainable society. This newsletter reports on projects happening at the intersection of crypto and climate so that people can understand and assess the opportunities they could get involved in.

In this issue, we explore whether and how bitcoin miners can help stabilize the grid as we move towards more renewable energy generation. The transition to renewable energy creates issues for the grid because the times when solar panels and wind turbines supply electricity don't always align with the times when there is a high demand for that electricity. Similarly, the places where demand is highest aren't always the sunniest and windiest. We will then look at how bitcoin miners implement the proof-of-work consensus algorithm and how that can help realign supply and demand. This article's goal isn't to judge whether Bitcoin in itself is a good idea or not, but just to focus on if and how it could help to reduce emissions.

We conclude that bitcoin miners can improve the economics of renewable power plants and help stabilize the grid, but add a sobering note on the additional electricity generation needed to power them. Even if they encourage more renewables to be built to power them, it would be more in line with reducing emissions to use that clean energy to cover existing demand and replace fossil fuel generation instead of using it to power bitcoin miners. Furthermore, other types of devices could provide the same services as bitcoin miners to help stabilize the grid. Bitcoin miners are probably here to stay though, so we might as well leverage them where we can, and make sure they are powered by clean energy!

Now let's dig into the details. We'll start by looking at how the electrical grid works and how renewable energy is changing it.

Renewable energy makes it more difficult to balance the grid by decoupling supply from demand

The role of the grid is to connect electricity supply with demand. This has to happen both in terms of space and time.

Space: the supply needs to be physically connected to the demand, for example with power lines

Time: the supply needs to match the demand at every moment of the day

Both need to match for the grid to be balanced. The frequency of the grid, which is how quickly the current oscillates in alternating current, stays within the expected range when the grid is balanced. If there is not enough supply, the frequency drops and the grid becomes unstable. This can force additional power generation to shut down and, in the worst cases, lead to full-on black outs.

Historically, balancing supply and demand has been relatively straightforward:

Space: the supply is placed physically close to the demand to reduce transmission costs, for example by building power plants in the vicinity of cities or factories.

Time: the supply is increased when demand increases, for example by turning on more gas power plants that can respond quickly.

Recently, we have seen more and more renewable energy generation, like solar and wind, which depend on factors that are out of our control. They deliver the huge benefit of not emitting any CO2, but the disadvantage is the decoupling of supply from demand, both in terms of space and time.

Space: The same wind turbine or solar panels may generate drastically different amounts of energy based on the location. Certain locations have a high potential for renewable energy, but may be distant from hubs of demand. This is notably the case in West Texas, where both wind and sunlight are abundantly present, but where there is little to no local demand.

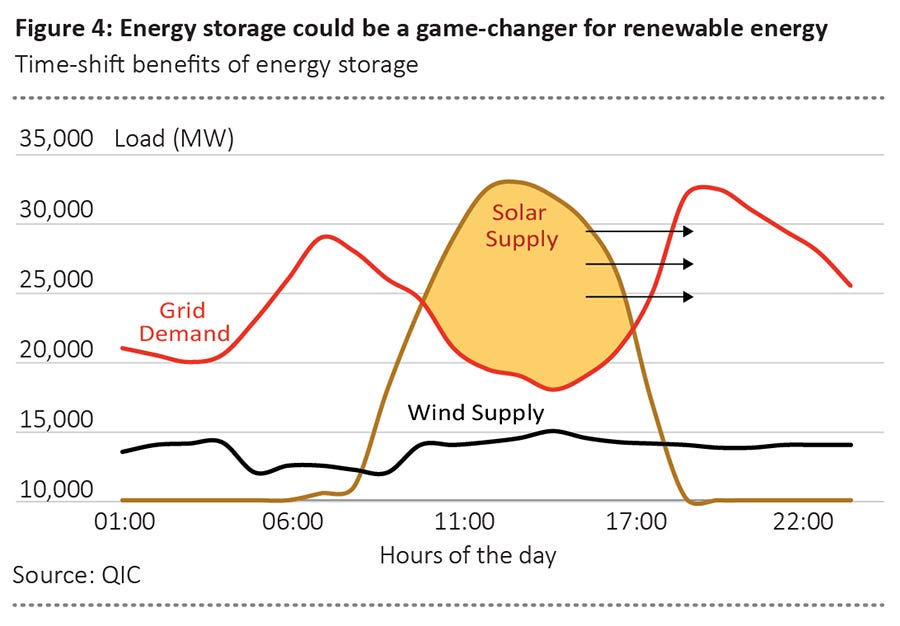

Time: Renewable energy is generated when the wind is blowing or when the sun is shining, which generally doesn’t match demand.

Furthermore, the problem is actually worse than simply adding new electricity generation that is decoupled from demand. Renewables are also gradually replacing existing electricity generation that were coupled with demand, because solar and wind are getting cheaper than coal and gas power plants, which means those are getting shut down. This is again great from the perspective of reducing CO2 emissions, but it exacerbates the decoupling of supply from the demand even more.

Of course, the benefit of reducing CO2 is the big story here. We want to find ways to continue to push for clean energy generation despite the decoupling challenges.

We also want to allow for drastic increases in demand for electricity, as cars and other industrial processes become electric. The idea that we should always adapt supply to demand will hinder progress towards our emissions goals. This is another reason to think about strategies to balance the grid despite the decoupling challenges.

There are several strategies to deal with the decoupling in terms of space and time, each with their own pros and cons.

In terms of space, we have two options.

We can build transmission lines to connect the new supply to the demand. China does this very well. In western countries, building new transmission lines is slow and costly. You also need to account for line losses over long distances. They will be lower with high-voltage lines, but those are even more expensive to build.

We can move demand closer to the supply. Unfortunately, most devices that consume electricity, called electrical loads, have their own geographical restrictions such as being close to cities.

In terms of time, we can think of our options according to the following three categories.

We can adjust the supply to the demand. In the fossil-fuel world, this means adding more flexible capacity like gas power plants that can react quickly. In the renewable world, we cannot increase electricity generation beyond what the natural resources provide, we can only curtail generation. This is equivalent to throwing the energy away, which is why it is only used as a last resort.

We can adjust the demand to the supply. This can take the drastic form of load shedding where entire neighborhoods are left with no electricity for some time, or demand response programs where loads are asked to increase or decrease their demand. These demand response programs already help grids today, but only certain loads will ever be able to be turned on and off at a moment's notice.

Lastly, we can use batteries to store some of the supply and use it later. Those can be utility-scale batteries that return the energy to the grid or smaller batteries that are collocated with a load to store the electricity when it's cheap and use it when it is expensive. The potential here is enormous and batteries are already being deployed at exponentially increasing rates.

Some claim that so-called bitcoin miners can improve the profitability of renewable projects and also help stabilize the grid by helping to re-couple supply with demand. They could do so in terms of space, because they can be deployed anywhere, and they could do so in terms of time, because they are ideal for demand response programs. To better understand these claims, we need to understand how Bitcoin works and how that translates into useful properties for the grid.

Bitcoin mining is mobile and interruptible

Let's take a deep dive into what Bitcoin is, how it works, and what it can mean for the grid, including its infamous energy consumption.

This section goes through the fundamentals of how Bitcoin works and what bitcoin miners do, for those that are interested. It is not central to understanding this article, so feel free to skip to the conclusion at the end of the section.

Bitcoin is a distributed currency that is implemented as a public and distributed database of all historical transactions. Participants can run through all transactions in the database to compute the balance of each account, and to validate that no account ever spent more than what they owned. These transactions are grouped in blocks, chained one after the other in a so-called blockchain.

Participants in the network will create new blocks, i.e. choose which transactions to include in a block and in what order. The goal of the system is to reach a decentralized consensus on who gets to create the next block. It has to be done in a decentralized way, so that no authority can decide to censor certain transactions and to force everybody to follow the rules agreed upon. For example, if the rules say you can't print money, the network won't accept transactions that do.

Each participant that produces a new block is incentivized to do so with a reward, by allowing them to insert a special transaction in the block that adds money to their account. If a participant ever decides to fork the main chain and to advertise a different history of blocks to the network, the rule that the protocol follows is to always choose the longest fork. Because each participant knows that other participants will also choose the longest fork, they are incentivized to add their new block, which includes their reward, to the longest chain too. It then becomes important that at least half of the new blocks created are created by honest participants, e.g. that are not trying to censor certain transactions, so that the longest chain is also the honest one.

One way to decide who should create the next block, is to ask participants to each produce a block, one participant after another. The problem with this method is that it's very hard to know who is a "real" participant in the network. If the network has 500 participants, a malicious actor may create 1000 fake accounts very easily to look like 1000 participants. This is called a sybil attack and would give them the right to create the majority of blocks and allow them to compromise the network.

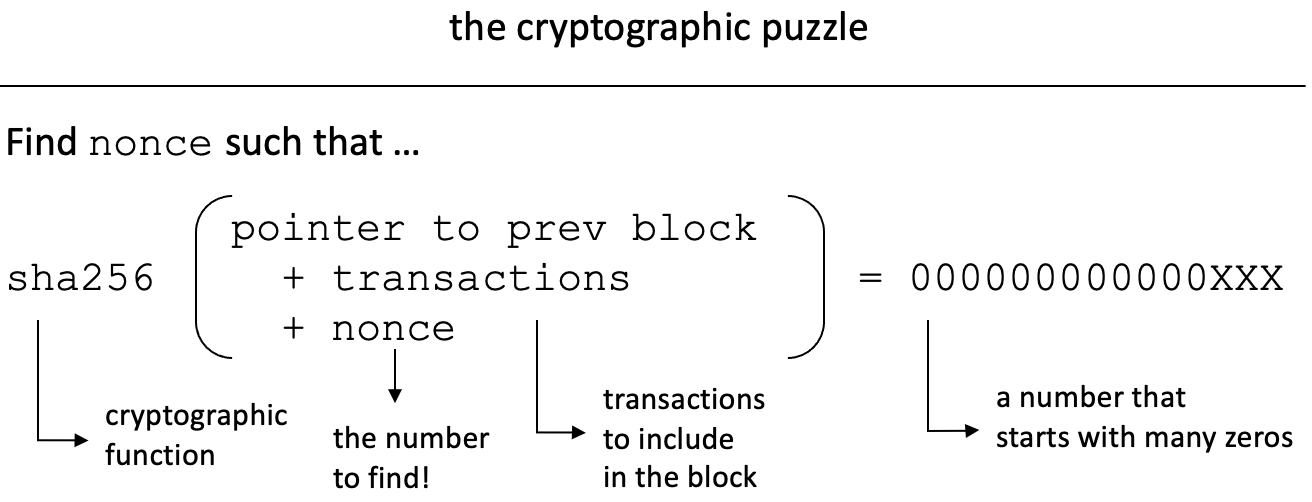

Bitcoin's innovation is the Nakamoto Consensus, aka Proof of Work, which says that the first participant who solves a cryptographic puzzle can produce the next block. In this method, participants need to find the value which, when passed to the hashing function sha256, will produce a result that starts with a certain number of zeros. The cryptographic properties of sha256 mean that the only way to find a solution is by trial and error.

The chances of one random number being a solution to the puzzle is one in ten trillion (at time of writing), so to actually find a solution requires an enormous amount of trial and error, which is what drives the energy consumption of Bitcoin. It takes all the computers in the network an average of 10 minutes to find a solution.

Every participant has a probability of being the first one to find a solution that is proportional to how much computing power they have, i.e. how many attempts at the cryptographic puzzle you can try per second. A malicious actor would then have to control more than half of the computing power of the whole network to be able to produce the majority of the blocks and compromise the network. At time of writing, this corresponds to procuring and running $15B worth of computers. The more actors participate in the proof of work consensus, the harder it becomes for a malicious actor to take over the network.

As mentioned earlier, to reward participants for securing the network, the participant who finds a solution to the puzzle and creates the block gets a reward in bitcoin. This is why the process is called bitcoin mining and the computers are called miners. This is the incentive that is driving the bitcoin mining industry and is also the network's attempt at a fair distribution of bitcoin to its participants over time.

Each attempt at solving the cryptographic puzzle is independent from previous attempts. This means mining can easily be interrupted. The probability of finding a solution is just a linear function of the number of attempts you make.

Bitcoin mining operations only need power for the computers and an internet connection to connect to the Bitcoin network. The latter can be found anywhere in the world these days with a good internet satellite connection like Starlink. This allows bitcoin miners to be placed anywhere where there is a power source.

Note that there are other consensus mechanisms, like Proof of Authority or Proof of Stake, that don't require solving cryptographic puzzles and only consume a fraction of the energy. Each of these consensus mechanisms make different tradeoffs and different blockchains will choose different ones. The Bitcoin community is focused on decentralization and having a protocol that has immutable properties (like gold) so it is sticking with Proof of Work. On the other hand, the Ethereum community has decided to forgo the simplicity of Proof of Work and to migrate to Proof of Stake to reduce the network’s energy consumption by ~99.95%.

In conclusion:

Bitcoin miners are computers that are rewarded for securing the Bitcoin network by doing lots computation

Bitcoin miners consume a lot of electricity

Bitcoin miners only need a power source and an internet connection

Bitcoin miners are interruptible, you can stop them at any time and restart them later

Now that we understand the different characteristics of bitcoin miners, let's see how they can help the economics of renewables and stabilize the grid.

Bitcoin miners help to build out new renewable power plants

Like any business, bitcoin miners are always trying to reduce their costs to improve their profitability. By far their highest operational cost will come from the price of their electricity, which means they will look for cheap energy. Renewables like wind and solar have become cheaper than fossil fuels in recent years. Many businesses require affordable electricity, but the advantage of bitcoin miners is that they can be installed where the cheap electricity is generated. At the same time, a flexible load like a bitcoin miner can help the economics of renewable energy projects when they are co-located. Let's explore when this is the case.

A common problem faced by renewable projects is that areas that have access to the grid and the best wind and solar conditions quickly become crowded with other renewable projects and are located far away from consumption. The transmission line capacity to connect these projects to transport electricity from these areas to centers of consumption is limited and as we mentioned, building additional transmission is a costly, long process.

As the transmission lines get close to capacity, the price of electricity at the congested nodes goes down. The lower price will make it less profitable for local power plants to produce electricity, and more attractive for local loads to consume the electricity before it makes it to the transmission line. In some cases, the price of electricity will become negative, sending a clear signal to power plants that they should curtail some of their electricity production.

A bitcoin miner could set up shop at one of these congested nodes to reduce the peak supply that makes it to the transmission line. The additional load would improve the economics of all renewables at that node by reducing the frequency and magnitude of those lower or negative prices [podcast]. In the US, negative real-time hourly wholesale prices occur between 2% and 4% of all hours and wholesale market nodes, primarily impacting wind farms [paper]. Adding bitcoin miners at those strategic places can increase revenue for renewable energy projects by 20% to 50% [podcast].

Bitcoin miners can also help when an area has great potential for solar or wind, but it could be uncertain when transmission lines will be built or if they ever will be. Here, bitcoin miners can lower the risk of building renewable projects in the area by providing them with an alternative business model while they are waiting for the grid [podcast].

Bitcoin miners help stabilize the grid

Once bitcoin miners are connected, they can become an asset for grid operators that want to stabilize their grids. For example, when there is too much demand or not enough supply, bitcoin miners can work with operators to reduce their load to help realign supply and demand. They usually do so using one of two frameworks.

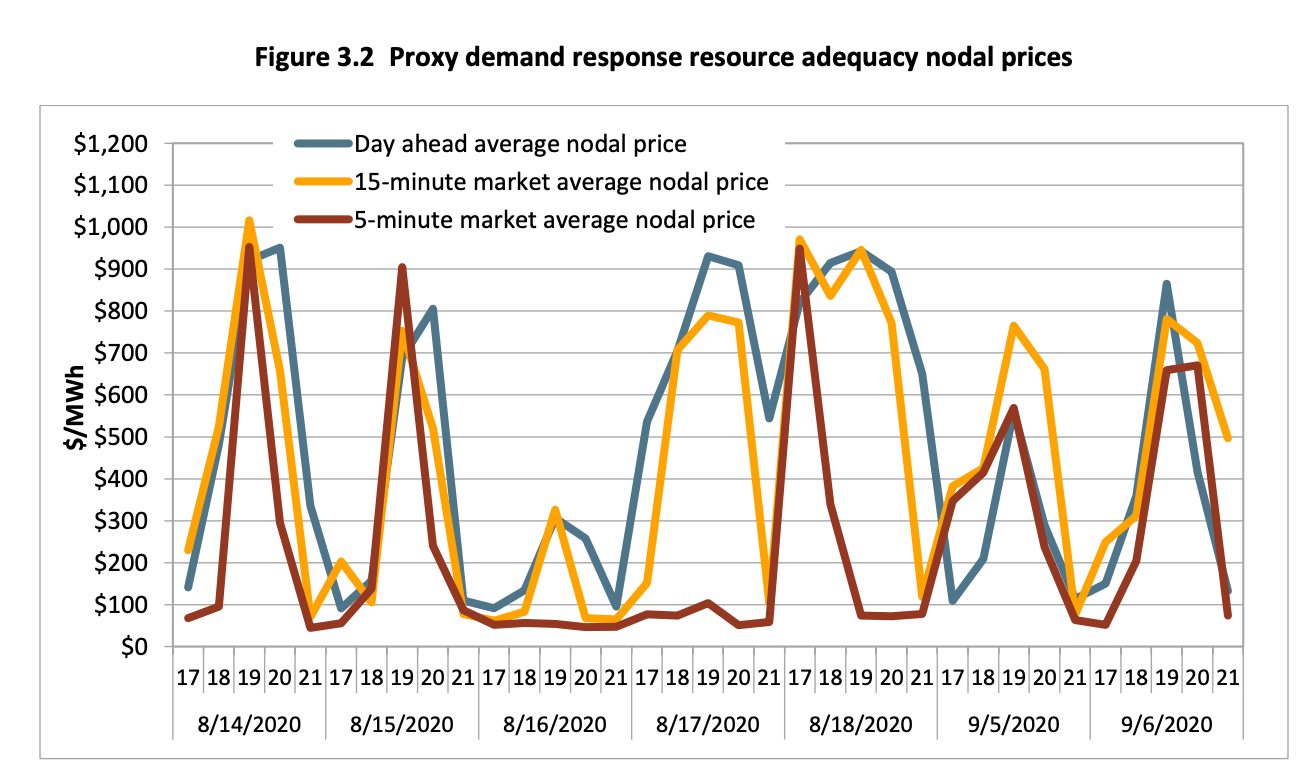

The first one is classic demand response programs where different loads like thermostats will reduce their demand on the grid during sustained periods of peak demand or under supply. In this case they can have 10-30 minutes to reduce their consumption of electricity. Different demand response programs will have different incentives to participate. For example, in California [link], loads can bid in the day-ahead energy market to say how much they are willing to be paid to reduce their load. The operator selects the lowest bids and will pay that amount to the selected participants to reduce their load on the next day if they end up needing them to do so. If a bitcoin miner produces 500$/MWh [podcast], it will bid to reduce their load so long as the market price is higher than that amount, as was the case in California during hot summer days in 2020.

The second one is the frequency regulation market where loads have to react extremely quickly to unexpected events. For example, when a cloud goes over a large solar farm, the supply of electricity will suddenly drop and the frequency of the grid will go down with it. Bitcoin miners shine here because they can reduce their load within seconds. Here again different types of incentive structures exist, and bitcoin miners will participate when it makes economic sense.

When the grid is not capable of matching supply to demand through the above programs or by increasing generation, it is at risk of catastrophic failure. These events can be caused by multiple power plants going down, causing supply to be extremely low, or extreme weather, causing supply issues or excessive demand. In those cases, the grid operator can decide to increase electricity prices to reduce demand. Many critical loads aren't able to reduce their demand, but the economic calculus for bitcoin miners is so simple that you can guarantee they will shut down as soon as it becomes unprofitable for them to run.

In conclusion, there are cases in which bitcoin miners could help stabilize the grid by shutting themselves off for short amounts of time. Bitcoin miners aren't unique in their ability to help the grid though. In the next section, we'll look at other types of loads that could provide similar services.

Bitcoin mining compared to other loads

The most obvious alternative to bitcoin miners to help the economics of renewables and to help stabilize the grid are utility-scale batteries.

Like bitcoin miners, batteries can be co-located with renewable energy generation to help their economics, by allowing them to store electricity when the price is low, and selling their electricity back into the grid when the price is high. This has the added benefit of being extremely useful to help stabilize the grid by matching supply and demand. These batteries are also extremely fast to control, so they can react in less than a second to support the grid.

From a grid operator’s perspective though, having a diversity of assets that are capable of participating in demand response programs and providing a flexible response to market price signals makes sense and can help improve reliability. It can help grid resiliency to have bitcoin miners in addition to batteries, other demand response services and, for now, gas peaker plants. The additional resiliency comes from the fact that if some assets were to fail, other asset types would continue to provide a flexible response.

Overall, there are many cases where batteries could replace bitcoin miners to help stabilize the grid, in a way that reuses the energy for existing demand. Their current limitation though is that it will take a long time for battery production to scale to the levels required by our emissions goals, so it can make sense for bitcoin miners to help in the meantime.

Another category of alternatives are other types of computation loads. Companies that run expensive computation such as video rendering or machine learning, may seek to reduce their costs and emissions by running their computation directly at renewable energy projects. In these cases, the tasks may not be as interruptible as bitcoin mining, because they have to save their results before they shut down, but could still be fast enough for grid operators and markets are beginning to appear [example].

There could also be other types of load that are directly useful for other climate change goals, such as the production of clean hydrogen (through electrolysis) [paper] or other zero-emission fuels, and using the electricity to capture CO2 from the atmosphere and sequester it deep underground. It won't be possible to replace bitcoin miners or batteries with these alternatives everywhere as they have more specific requirements, such as infrastructure to transport the produced fuel or the right underground reservoirs to store the carbon, but their additional utility makes them extremely interesting where possible.

Lastly, bitcoin miners have regulatory risks. They are already banned in China and could be banned in other countries soon. That should also be accounted for when choosing to invest in them.

Conclusion

We've seen how demand and supply for electricity get decoupled as we build more renewable energy facilities, both in terms of space and time, and the challenges that this poses to grid operators.

Meanwhile, bitcoin miners are extremely flexible. They can be installed virtually anywhere, and when collocated with renewable energy facilities or strategically placed at congested nodes of the grid, they can improve the economics of renewable energy power plants. They can also be quickly shut down without worry of losing any work done, which makes them ideal to participate in demand response programs and frequency regulation markets to help align demand with supply of electricity. From a grid operator's perspective, they are a new type of asset that can help make the grid more reliable as we move towards more renewables.

On the other hand, a lot of new electricity generation will have to come online to support bitcoin miners. Even if most of it will come from new renewables that they helped finance, it won’t help reduce emissions if the new renewable energy is used to power bitcoin miners instead of replacing existing fossil fuel generation.

We could also help stabilize the grid by other means. For example, we could store energy in batteries to further help balance supply and demand, returning it to the grid when needed, or we could use other flexible loads that are directly useful for our climate change goals like the production of clean hydrogen.

It is still true that in those cases where 1) we are already blocked from adding more renewables due to grid instability, and 2) while batteries are still hard to get and 3) the location makes it impractical to use other types of flexible loads, then it may indeed make sense to add bitcoin miners to help stabilize the grid and unlock more investments in renewables. In reality though, today, the deployment of more renewables to replace fossil fuels is more often blocked by other factors than grid stability [paper].

In the end, one could also argue that we shouldn't prevent people from using energy, and bitcoin miners are here to stay. So we might as well make sure they are powered by clean energy and that we leverage them to stabilize the grid and help the profitability of renewable energy projects, but we shouldn’t expect bitcoin miners to have a big impact on reducing our emissions.

Before I leave you, other notes and happenings:

Find us on Twitter @thorgutierrez and @all4climatedao

All for Climate DAO is organizing Regens Unite, a 2-day conversation May 19-20 (+ 2-day hackathon) in Brussels to explore how we can move from sustaining the status quo to regenerative solutions, where resources are renewed, we build capacity again and we become more resilient to shocks.

Refi DAO is organizing their Planet Positive NFT Hackathon April 22-24 to innovate on how to use NFTs to create positive impact on the world.

Web3 for climate is another newsletter by the venture DAO Aera Force and covers weekly events in the web3 and climate space.

Thanks to Marie Washer, Philip Henry de Frahan, Xavier Damman for providing very valuable feedback on many drafts!

Resources

Content in this article was gathered from many sources. We selected the best ones below so you can dig into those topics further.

Proof of Work: part 1 and part 2

Podcasts with companies helping energy power plants leverage bitcoin miners

Podcast of non-crypto energy nerds that discuss the topic

Lancium white paper that simulates the impact on the grid of adding different types of bitcoin miners and concludes that bitcoin miners can spur more renewable capacity than they will consume

Square white paper that argues that bitcoin is key to an abundant clean energy future

Paper on negative electricity wholesale prices

Paper on the barriers preventing the deployment of renewable energy

Paper on using hydrogen production as flexible load to balance the grid